Navigating the Tax Season: Understanding the Factors Influencing Your TurboTax Refund Timeline

Related Articles: Navigating the Tax Season: Understanding the Factors Influencing Your TurboTax Refund Timeline

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Tax Season: Understanding the Factors Influencing Your TurboTax Refund Timeline. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Tax Season: Understanding the Factors Influencing Your TurboTax Refund Timeline

Tax season can be a stressful time, filled with paperwork, calculations, and the anticipation of receiving a refund. TurboTax, a popular tax preparation software, offers a range of tools to help navigate this process, including information on potential refund timelines. While a specific "TurboTax refund calendar" does not exist, understanding the factors that influence the timing of your refund can provide clarity and peace of mind.

Factors Affecting Refund Timing:

Several key factors contribute to the timeframe for receiving your tax refund, regardless of whether you use TurboTax or another method:

- Filing Method: Electronic filing (e-filing) generally results in faster processing times compared to paper filing. The IRS prioritizes processing electronically filed returns, which can significantly impact the speed of receiving your refund.

- Tax Filing Status: Filing status, such as single, married filing jointly, or head of household, can influence the processing time. Certain filing statuses may involve additional review processes, potentially extending the timeline.

- Completeness and Accuracy of the Return: A complete and accurate tax return is crucial for efficient processing. Errors or missing information can lead to delays as the IRS needs to contact you for clarification.

- IRS Processing Capacity: The IRS faces a high volume of tax returns during peak season. Processing times can fluctuate based on the agency’s capacity and staffing levels, potentially impacting refund timelines.

- Claiming Credits and Deductions: The complexity of your tax return, particularly if you claim various credits or deductions, can influence processing time. The IRS may need additional time to verify the accuracy of these claims.

- Identity Verification: The IRS may require additional identity verification if there are discrepancies in your return or potential fraud concerns. This process can significantly delay the refund timeline.

- Direct Deposit: Opting for direct deposit generally leads to faster refund delivery compared to receiving a paper check. The IRS electronically transfers funds directly to your bank account, reducing the processing time.

Understanding the IRS Processing Timeline:

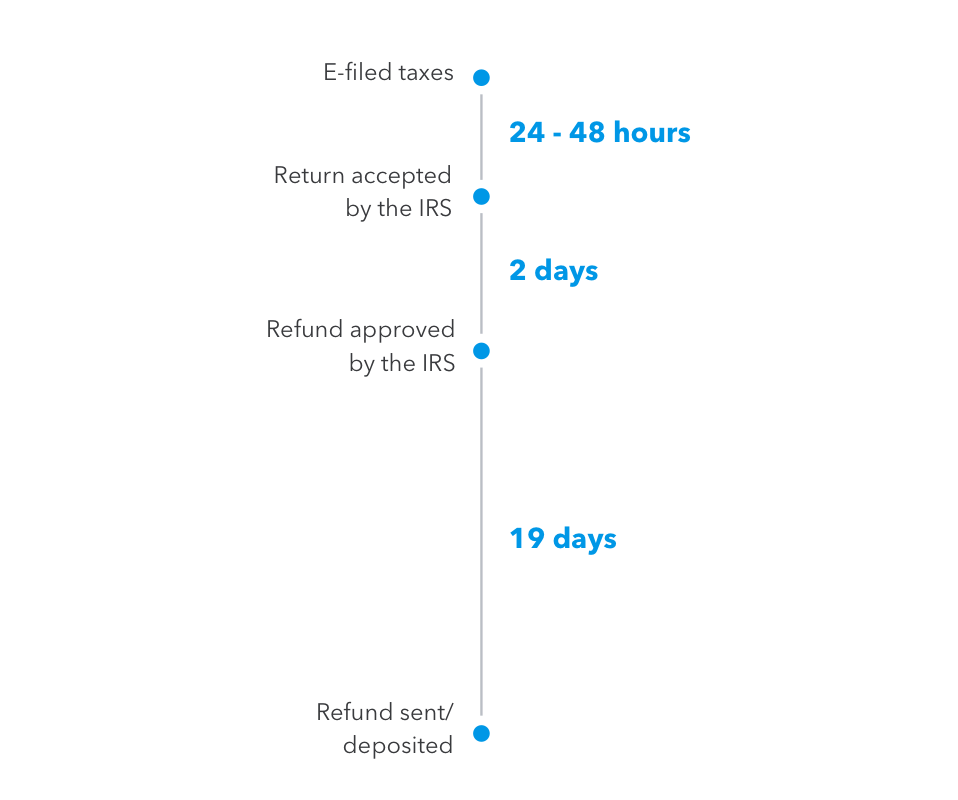

The IRS typically aims to process tax returns within 21 days of e-filing. However, this is only an estimate, and actual processing times can vary significantly. The IRS provides a tool called "Where’s My Refund?" that allows taxpayers to track the status of their refund. This tool provides updates on the processing stage and estimated delivery date.

Tips for Optimizing Refund Timing:

- File Electronically: E-filing is the most efficient method to ensure timely processing.

- Double-Check for Accuracy: Carefully review your tax return before submitting it to avoid errors that could lead to delays.

- File Early: Filing your return early in the tax season can help minimize processing delays, especially if you expect a refund.

- Utilize Direct Deposit: Opting for direct deposit ensures faster delivery of your refund.

- Stay Informed: Utilize the "Where’s My Refund?" tool to track the status of your refund and remain informed about any potential delays.

FAQs Regarding Refund Timing:

1. How long does it usually take to receive a tax refund after e-filing?

The IRS aims to process tax returns within 21 days of e-filing. However, this is an estimate, and actual processing times can vary.

2. Why is my refund taking longer than expected?

Several factors can contribute to delays, including:

- Completeness and accuracy of the return: Errors or missing information can lead to delays.

- IRS processing capacity: High volumes of tax returns can impact processing times.

- Claiming credits and deductions: Complex returns may require additional review.

- Identity verification: The IRS may need to verify your identity, which can delay processing.

3. How can I track the status of my refund?

You can use the IRS’s "Where’s My Refund?" tool to track the status of your refund. This tool provides updates on the processing stage and estimated delivery date.

4. Is there a way to expedite the refund process?

While there is no guaranteed way to expedite the process, e-filing and opting for direct deposit generally lead to faster refund delivery.

5. What should I do if my refund is delayed?

If your refund is significantly delayed, you can contact the IRS for assistance. You should have your tax return information available when contacting the IRS.

Conclusion:

Understanding the factors that influence refund timing is essential for navigating the tax season effectively. By utilizing resources like TurboTax and the IRS’s "Where’s My Refund?" tool, taxpayers can stay informed and manage their expectations regarding refund delivery. While the IRS processing timeline can vary, taking steps to file accurately, electronically, and early can help optimize the speed of receiving your refund.

![Tax Season is Over: How Will You Spend Your Refund? [INFOGRAPHIC] The](http://images.blog.turbotax.intuit.com/swf/TurboTax-How-Americans-Spend-Their-Refund.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Tax Season: Understanding the Factors Influencing Your TurboTax Refund Timeline. We thank you for taking the time to read this article. See you in our next article!