Navigating the New Jersey State Payroll Calendar: A Comprehensive Guide for 2025

Related Articles: Navigating the New Jersey State Payroll Calendar: A Comprehensive Guide for 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the New Jersey State Payroll Calendar: A Comprehensive Guide for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the New Jersey State Payroll Calendar: A Comprehensive Guide for 2025

The New Jersey State Payroll Calendar for 2025 serves as a vital tool for businesses and organizations operating within the state, ensuring timely and accurate payroll processing. This calendar outlines key dates for payroll submissions, tax deadlines, and other relevant financial obligations. Understanding and adhering to this calendar is essential for maintaining compliance with state regulations and avoiding potential penalties.

Understanding the Calendar’s Significance

The New Jersey State Payroll Calendar is not merely a list of dates; it acts as a roadmap for financial management within the state. It provides a clear framework for:

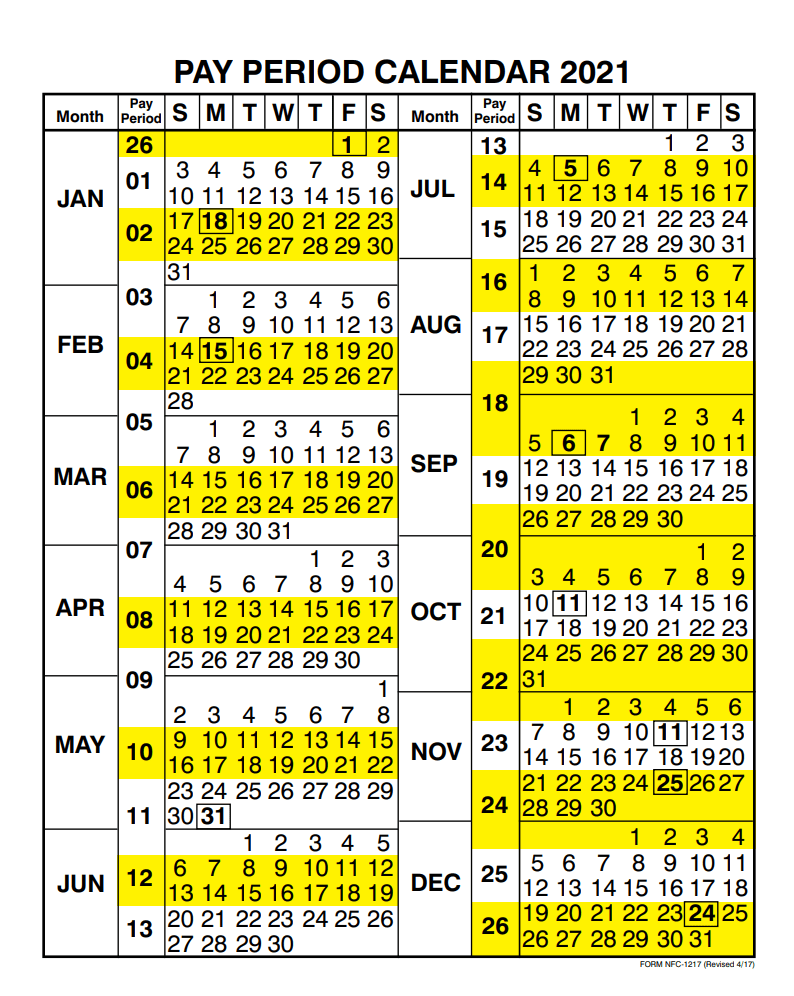

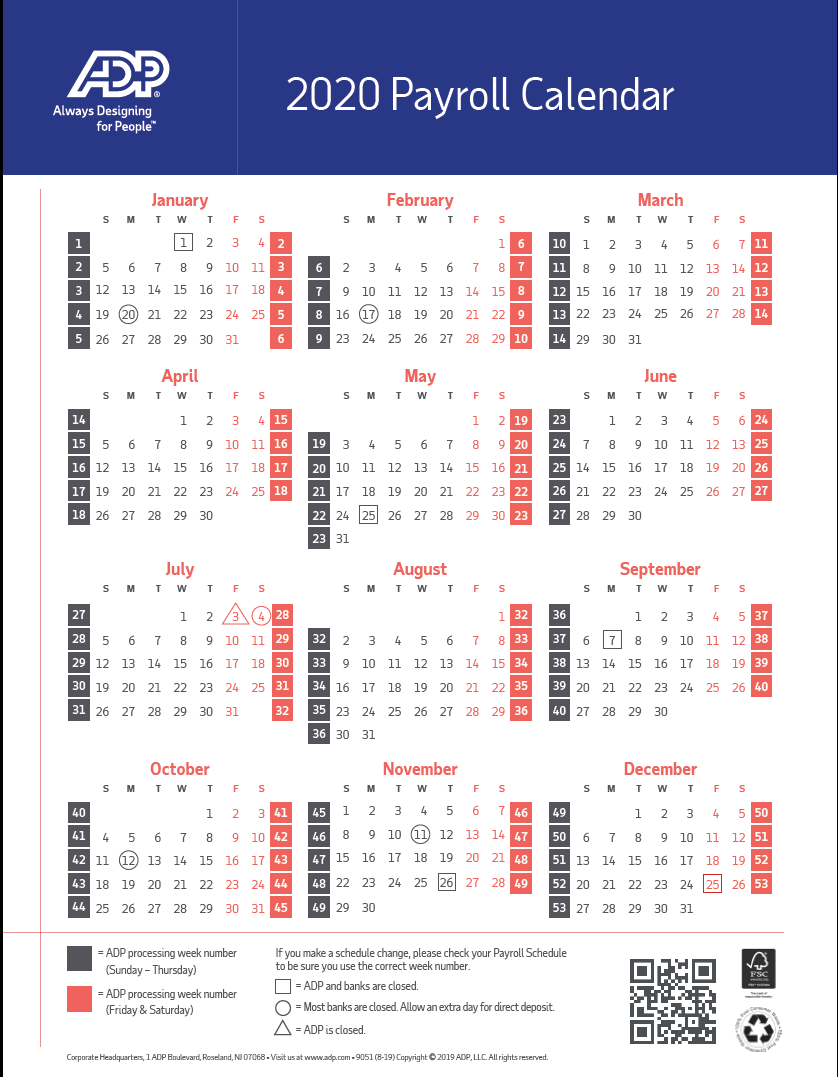

- Payroll Processing: The calendar identifies specific dates for submitting payroll reports and making tax payments. This allows businesses to plan their payroll cycles effectively, ensuring timely payments to employees and accurate tax remittances.

- Tax Compliance: The calendar highlights important tax deadlines, including quarterly and annual filings. This enables businesses to stay on top of their tax obligations, avoiding late penalties and potential legal ramifications.

- Financial Planning: The calendar facilitates better financial planning by providing a comprehensive overview of payroll and tax obligations throughout the year. This allows businesses to allocate resources efficiently and avoid unexpected financial burdens.

Key Elements of the New Jersey State Payroll Calendar

The New Jersey State Payroll Calendar typically includes the following key elements:

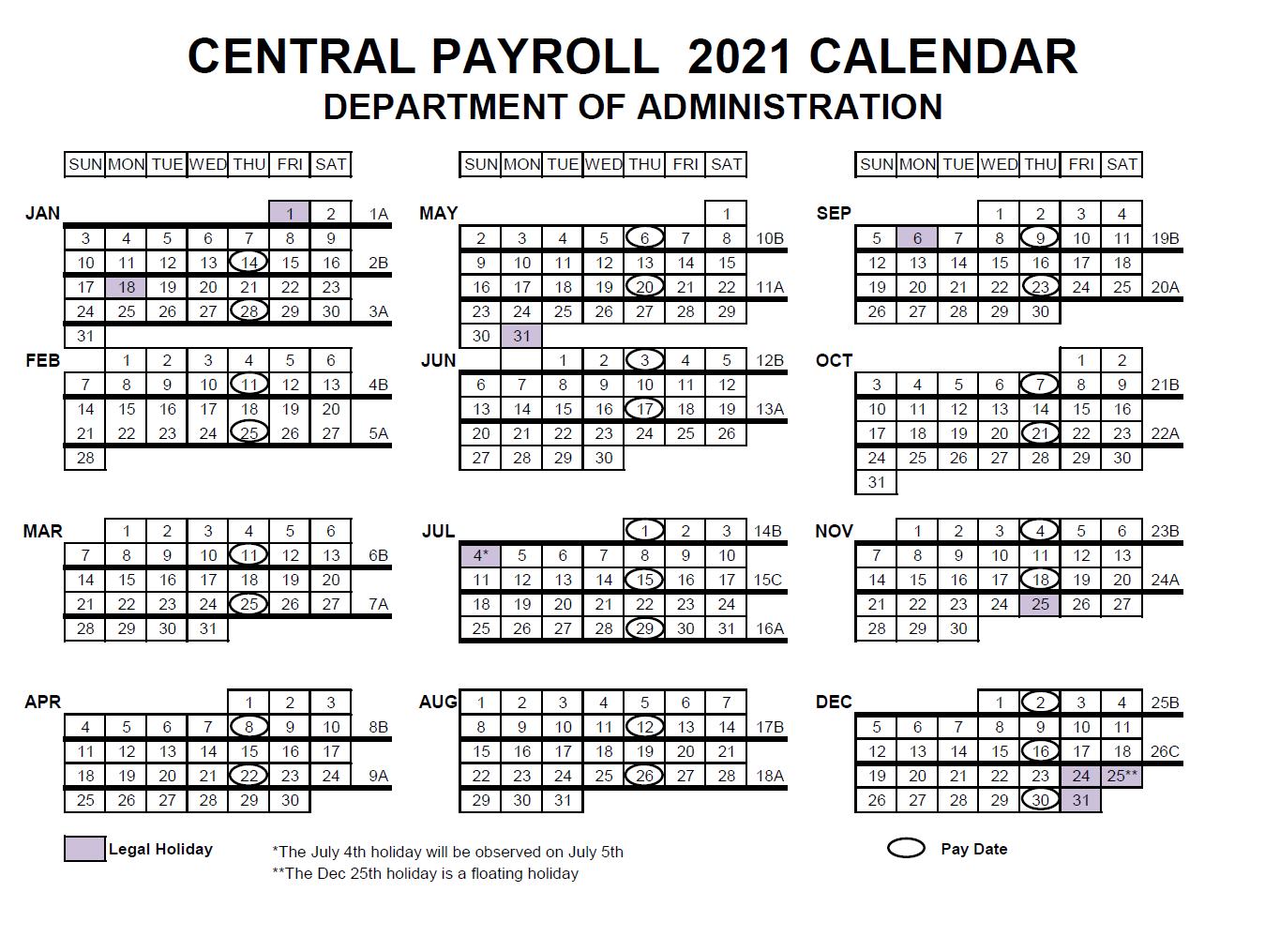

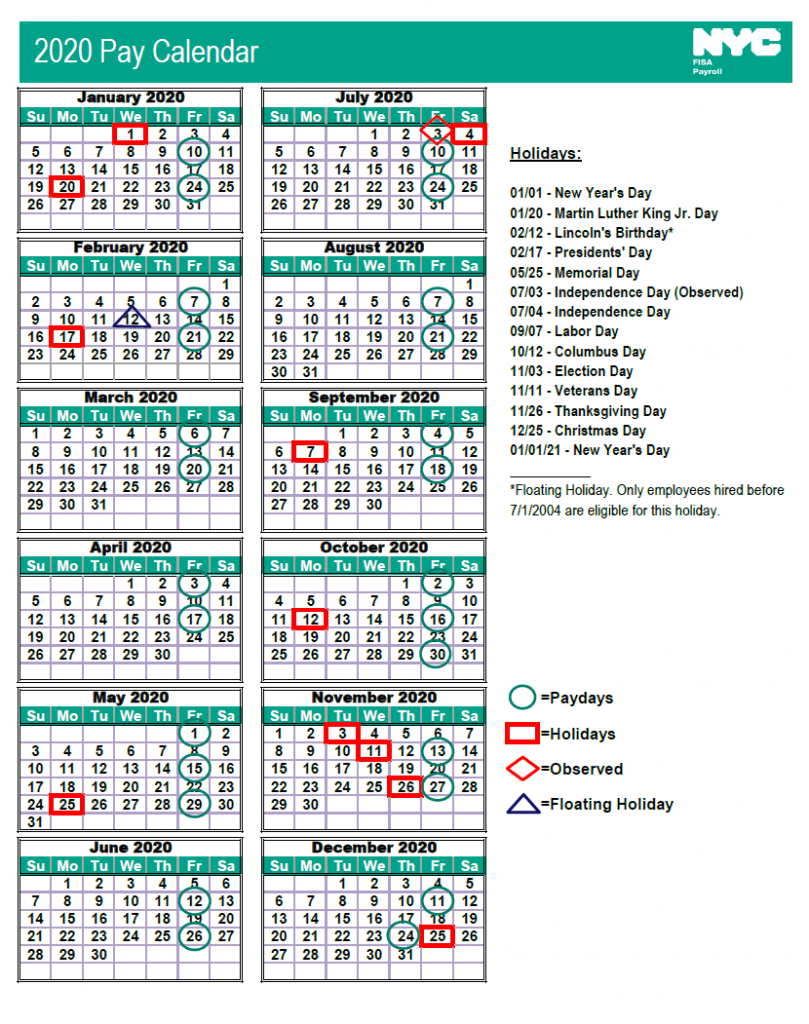

- Payroll Due Dates: This section lists the specific dates for submitting payroll reports and making payments for each pay period. It often distinguishes between regular payroll cycles and special situations, such as holiday pay periods.

- Tax Filing Deadlines: The calendar details the deadlines for various tax filings, including quarterly and annual income tax returns, unemployment insurance reports, and other relevant tax obligations.

- Holiday Schedules: The calendar may incorporate information regarding holidays observed in New Jersey, indicating potential changes in payroll cycles or tax deadlines.

- Important Notices: The calendar often includes important notices and updates from the New Jersey Department of Labor and Workforce Development, such as changes in tax rates or new regulations.

Accessing the New Jersey State Payroll Calendar

The New Jersey State Payroll Calendar is typically published and updated annually by the New Jersey Department of Labor and Workforce Development. It is usually accessible online through the department’s official website. Additionally, payroll software providers and accounting firms often offer access to state-specific payroll calendars, including the New Jersey calendar.

Tips for Utilizing the New Jersey State Payroll Calendar Effectively

- Review the Calendar Regularly: It is essential to review the calendar at the beginning of each year and throughout the year to stay informed of any changes or updates.

- Mark Important Dates: Mark important dates, such as payroll due dates and tax deadlines, on a calendar or planner to ensure timely compliance.

- Set Reminders: Utilize electronic reminders or calendar alerts to avoid missing critical deadlines.

- Consult with Professionals: If you have any questions or uncertainties about the New Jersey State Payroll Calendar, consult with a qualified payroll professional or an accountant.

Frequently Asked Questions (FAQs)

Q: Where can I access the New Jersey State Payroll Calendar for 2025?

A: The New Jersey State Payroll Calendar for 2025 is typically available on the official website of the New Jersey Department of Labor and Workforce Development. It is also often accessible through payroll software providers and accounting firms specializing in New Jersey payroll services.

Q: What if I miss a payroll deadline?

A: Missing a payroll deadline can result in penalties and interest charges. It is crucial to contact the New Jersey Department of Labor and Workforce Development to understand the specific consequences and explore options for resolving the issue.

Q: Are there any specific requirements for payroll reporting in New Jersey?

A: Yes, New Jersey has specific requirements for payroll reporting, including the use of designated forms and the submission of electronic reports through the New Jersey Department of Labor and Workforce Development’s online portal.

Q: How often are payroll taxes paid in New Jersey?

A: In New Jersey, payroll taxes are typically paid on a quarterly basis. However, businesses with specific circumstances, such as large employers or those operating in certain industries, may be required to pay taxes more frequently.

Q: What are some common payroll deductions in New Jersey?

A: Common payroll deductions in New Jersey include federal and state income taxes, Social Security and Medicare taxes, unemployment insurance, and workers’ compensation. Additionally, businesses may deduct other contributions, such as health insurance premiums and retirement plan contributions.

Conclusion

The New Jersey State Payroll Calendar is an indispensable resource for businesses operating within the state. By providing a comprehensive overview of payroll and tax obligations, it facilitates compliance with state regulations, minimizes financial risks, and allows for effective financial planning. By understanding and utilizing this calendar effectively, businesses can ensure timely payroll processing, accurate tax payments, and overall financial stability. It is crucial to stay informed about any changes or updates to the calendar throughout the year and consult with professionals when necessary to navigate its complexities.

Closure

Thus, we hope this article has provided valuable insights into Navigating the New Jersey State Payroll Calendar: A Comprehensive Guide for 2025. We appreciate your attention to our article. See you in our next article!