Navigating the Future of Payroll: A Comprehensive Guide to the 2025 Payroll Calendar Template

Related Articles: Navigating the Future of Payroll: A Comprehensive Guide to the 2025 Payroll Calendar Template

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Future of Payroll: A Comprehensive Guide to the 2025 Payroll Calendar Template. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Future of Payroll: A Comprehensive Guide to the 2025 Payroll Calendar Template

- 2 Introduction

- 3 Navigating the Future of Payroll: A Comprehensive Guide to the 2025 Payroll Calendar Template

- 3.1 Understanding the Significance of a 2025 Payroll Calendar Template

- 3.2 Key Features of a Comprehensive 2025 Payroll Calendar Template

- 3.3 The Benefits of Utilizing a 2025 Payroll Calendar Template

- 3.4 Implementing a 2025 Payroll Calendar Template

- 3.5 Frequently Asked Questions (FAQs)

- 3.6 Conclusion

- 4 Closure

Navigating the Future of Payroll: A Comprehensive Guide to the 2025 Payroll Calendar Template

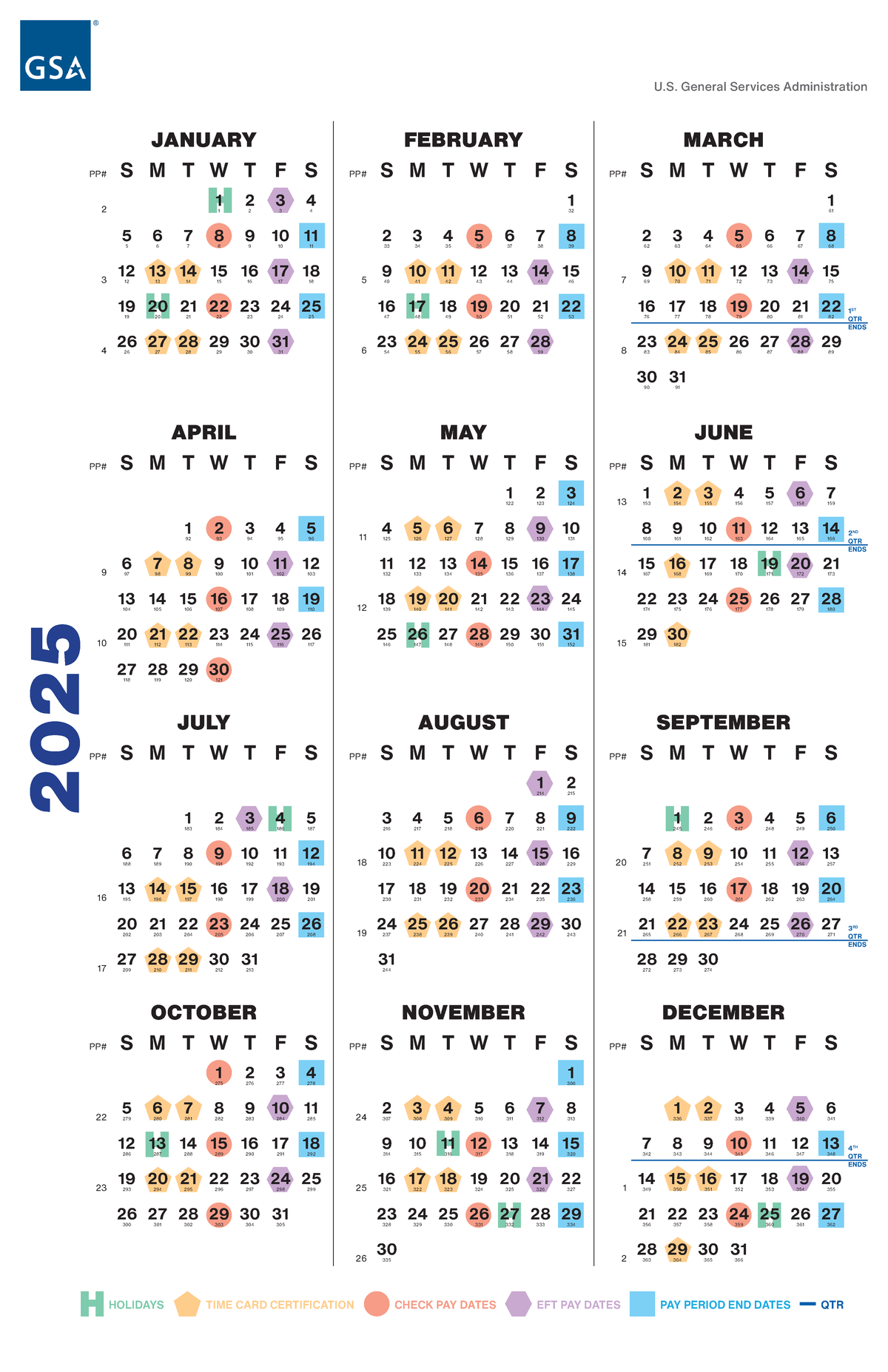

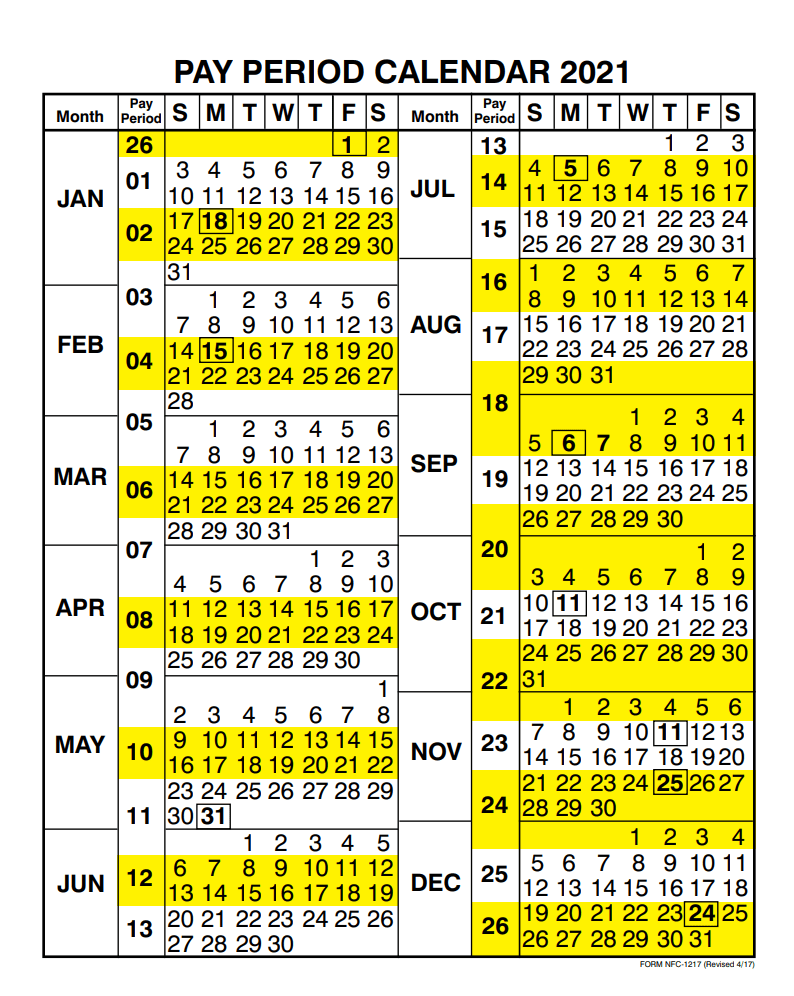

The year 2025 is fast approaching, and with it comes a new wave of challenges and opportunities for businesses. Staying ahead of the curve in payroll management is crucial for maintaining compliance, ensuring employee satisfaction, and optimizing financial health. One essential tool for navigating the complexities of payroll in 2025 is the payroll calendar template.

This article delves into the intricacies of the 2025 payroll calendar template, providing a comprehensive understanding of its features, benefits, and implementation strategies. We will explore its role in streamlining payroll processes, enhancing accuracy, and ultimately contributing to a smoother, more efficient work environment.

Understanding the Significance of a 2025 Payroll Calendar Template

The 2025 payroll calendar template serves as a central hub for managing all aspects of payroll, providing a structured framework for:

- Scheduling Pay Dates: The template clearly outlines payroll dates throughout the year, ensuring timely and consistent payments to employees.

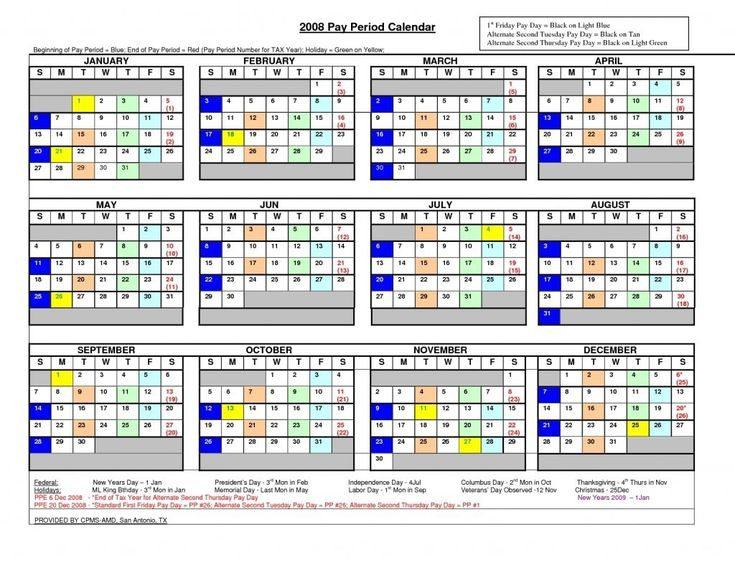

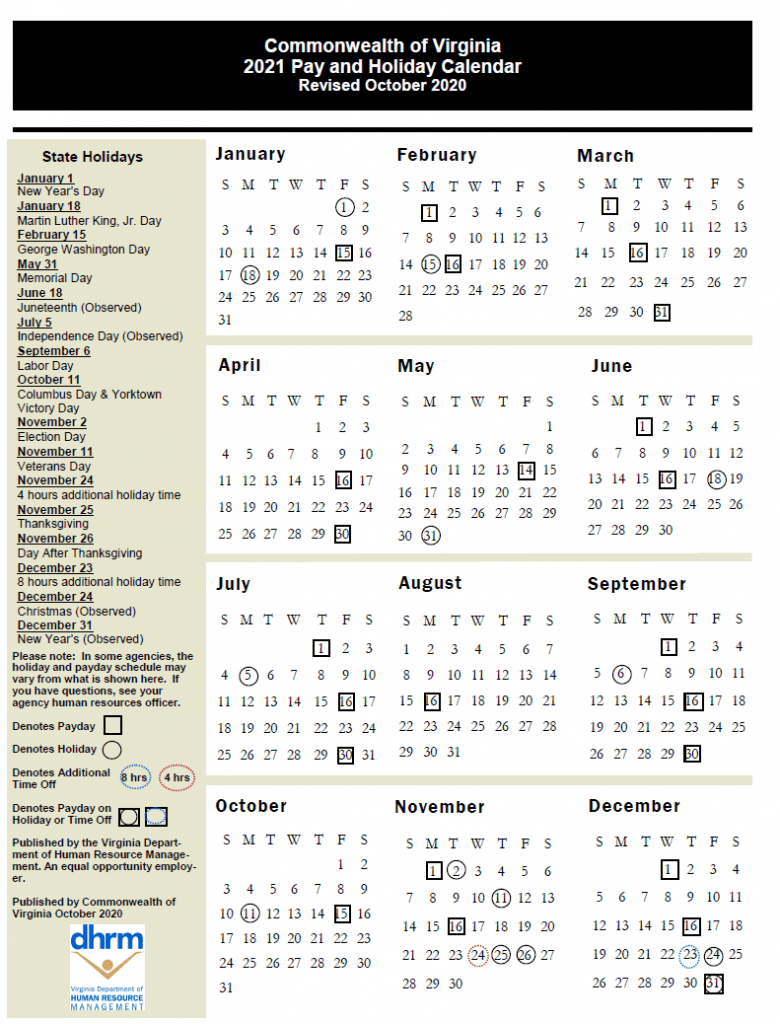

- Tracking Statutory Holidays: It incorporates all relevant statutory holidays, enabling businesses to accurately calculate and process payroll for periods including holiday pay.

- Identifying Payroll Deadlines: The template highlights key deadlines for various payroll-related tasks, such as tax filings, contributions, and reporting requirements.

- Managing Leave and Absences: It facilitates the tracking of employee leave, including vacation, sick leave, and unpaid time off, ensuring accurate payroll deductions and calculations.

- Planning for Payroll-Related Events: The template can be used to plan for payroll-related events, such as year-end tax adjustments, bonus payments, and other non-standard payroll activities.

Key Features of a Comprehensive 2025 Payroll Calendar Template

A robust 2025 payroll calendar template should encompass the following features:

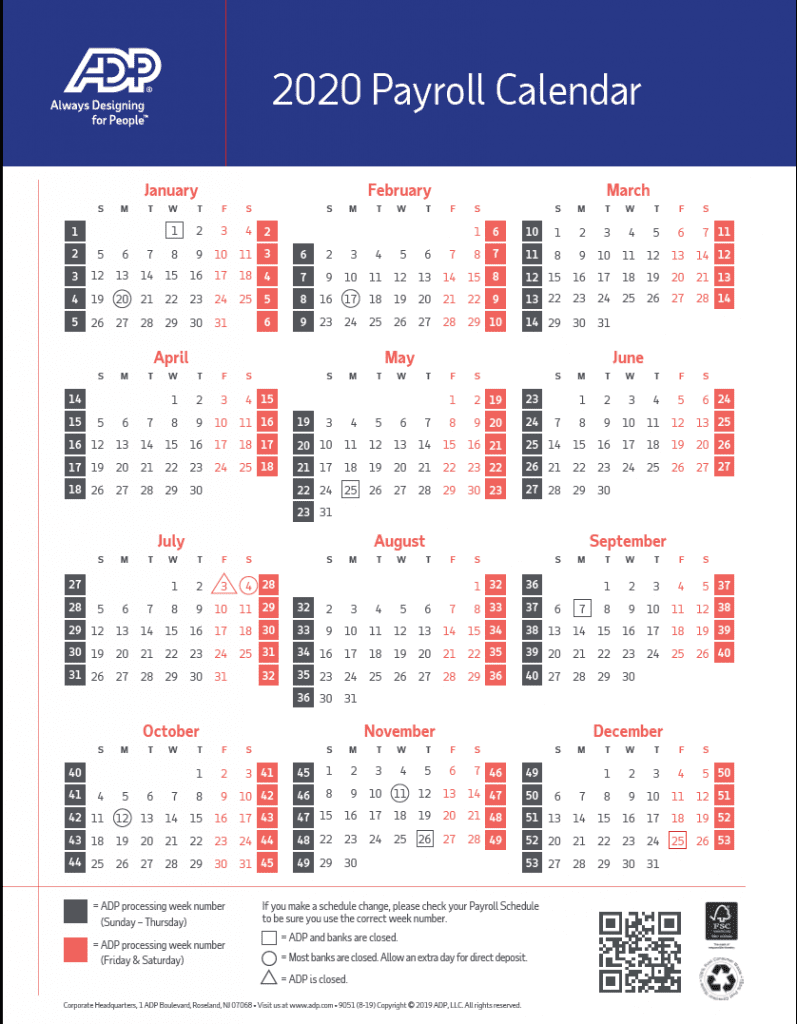

- Clear and Concise Layout: The template should be easy to read and understand, with a clear visual representation of payroll dates, deadlines, and other relevant information.

- Flexibility and Customization: The template should be adaptable to various business needs, allowing for customization of payroll frequency, pay periods, and other specific requirements.

- Integration with Payroll Software: The template should seamlessly integrate with existing payroll software, minimizing manual data entry and ensuring data accuracy.

- Automated Reminders and Notifications: The template should provide timely reminders and notifications for upcoming deadlines, ensuring compliance and avoiding potential penalties.

- Detailed Notes and Documentation: The template should include space for notes and documentation, allowing for the recording of important information related to specific payroll events or procedures.

The Benefits of Utilizing a 2025 Payroll Calendar Template

Implementing a 2025 payroll calendar template offers numerous benefits, including:

- Improved Accuracy and Efficiency: The template streamlines payroll processes, reducing the risk of errors and ensuring timely and accurate payments.

- Enhanced Compliance: By incorporating relevant statutory holidays and deadlines, the template facilitates adherence to legal requirements and minimizes the risk of penalties.

- Increased Visibility and Transparency: The template provides a clear overview of payroll activity, enhancing transparency and accountability within the organization.

- Reduced Administrative Burden: By automating reminders and notifications, the template significantly reduces the administrative burden associated with payroll management.

- Improved Employee Satisfaction: Timely and accurate payroll payments contribute to employee satisfaction and a positive work environment.

Implementing a 2025 Payroll Calendar Template

The implementation of a 2025 payroll calendar template involves several key steps:

- Choose the Right Template: Select a template that aligns with the specific needs and requirements of your organization, considering factors such as payroll frequency, employee structure, and compliance regulations.

- Customize the Template: Tailor the template to reflect your organization’s unique payroll practices, including pay periods, deductions, and reporting requirements.

- Integrate with Payroll Software: Connect the template with your existing payroll software to automate data entry and ensure seamless integration.

- Train Employees: Provide training to relevant employees on the use and functionality of the template, ensuring they understand its importance and can effectively utilize it.

- Regularly Review and Update: Regularly review and update the template to reflect changes in payroll regulations, company policies, or employee structure.

Frequently Asked Questions (FAQs)

Q: What are the legal requirements for payroll in 2025?

A: Payroll regulations are subject to change, and it is crucial to stay informed about the latest updates. Consult with legal and payroll professionals to ensure compliance with all applicable laws and regulations.

Q: Can I create my own payroll calendar template?

A: While you can create your own template, it is recommended to utilize a pre-designed template to ensure accuracy and compliance. Many reputable software providers offer customizable templates tailored to specific industry requirements.

Q: How often should I update the payroll calendar template?

A: It is recommended to update the template at least annually to reflect changes in statutory holidays, tax regulations, and company policies.

Q: Can I use a 2024 payroll calendar template for 2025?

A: It is generally not recommended to use an outdated template, as it may not accurately reflect the latest payroll regulations and deadlines.

Q: What are some best practices for using a payroll calendar template?

A:

- Maintain accuracy: Ensure all data entered into the template is correct and up-to-date.

- Communicate effectively: Share the template with relevant employees and ensure they understand its use.

- Be proactive: Use the template to anticipate potential payroll issues and address them proactively.

- Continuously improve: Regularly review and update the template to improve its effectiveness and efficiency.

Conclusion

The 2025 payroll calendar template is an indispensable tool for navigating the complexities of payroll management in the coming years. By streamlining processes, enhancing accuracy, and facilitating compliance, it contributes to a smoother, more efficient work environment. By embracing this valuable resource, businesses can streamline their payroll operations, optimize financial health, and focus on delivering a positive employee experience.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future of Payroll: A Comprehensive Guide to the 2025 Payroll Calendar Template. We appreciate your attention to our article. See you in our next article!