Navigating the Fiscal Landscape: A Comprehensive Guide to the 2025 Quarters Calendar

Related Articles: Navigating the Fiscal Landscape: A Comprehensive Guide to the 2025 Quarters Calendar

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Fiscal Landscape: A Comprehensive Guide to the 2025 Quarters Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Fiscal Landscape: A Comprehensive Guide to the 2025 Quarters Calendar

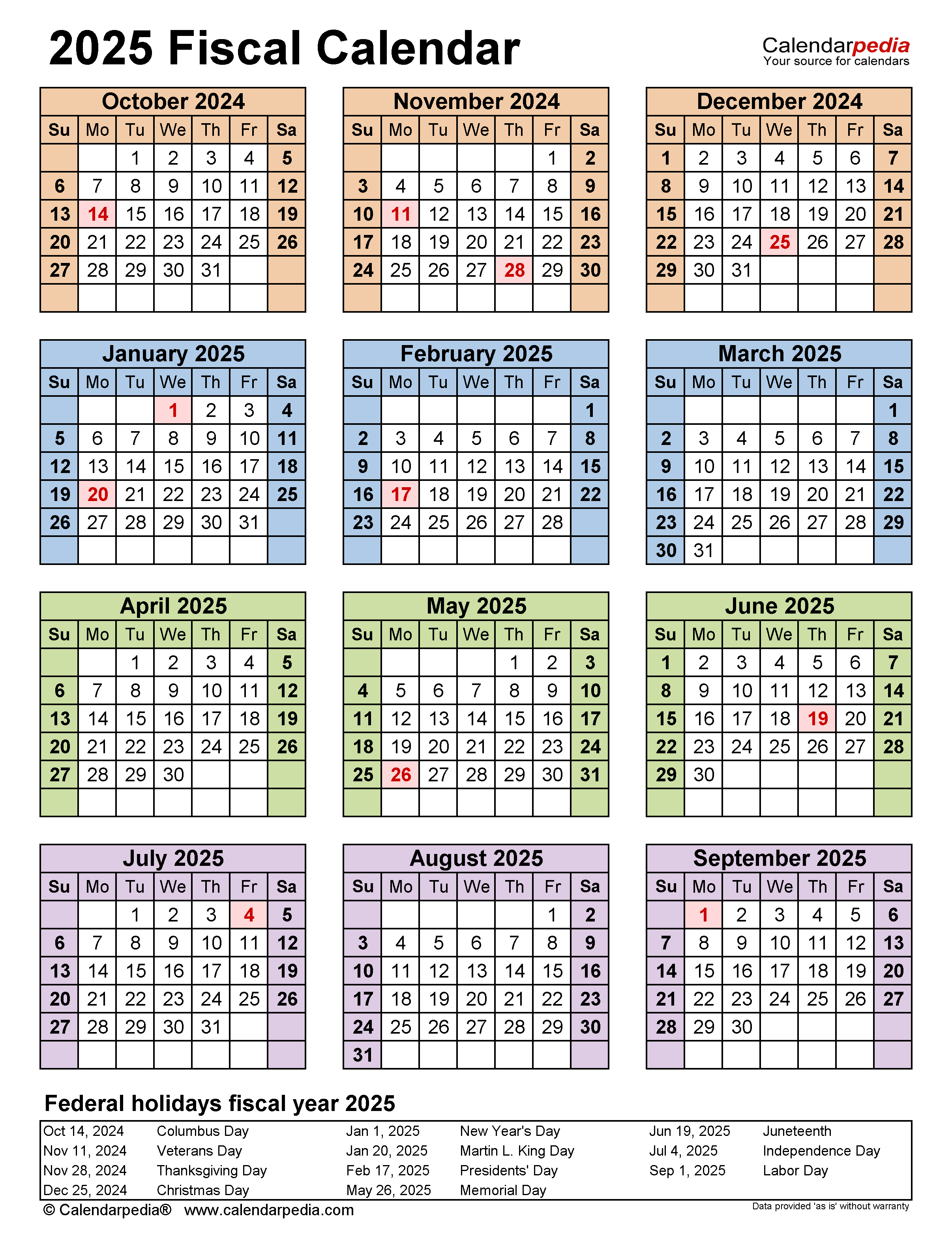

The 2025 quarters calendar serves as a crucial tool for navigating the fiscal year, providing a structured framework for businesses, investors, and individuals alike. This calendar divides the year into four distinct periods, each encompassing three months, allowing for efficient planning, tracking, and analysis of financial performance. Understanding its structure and applications is essential for making informed decisions in various financial contexts.

Understanding the Structure:

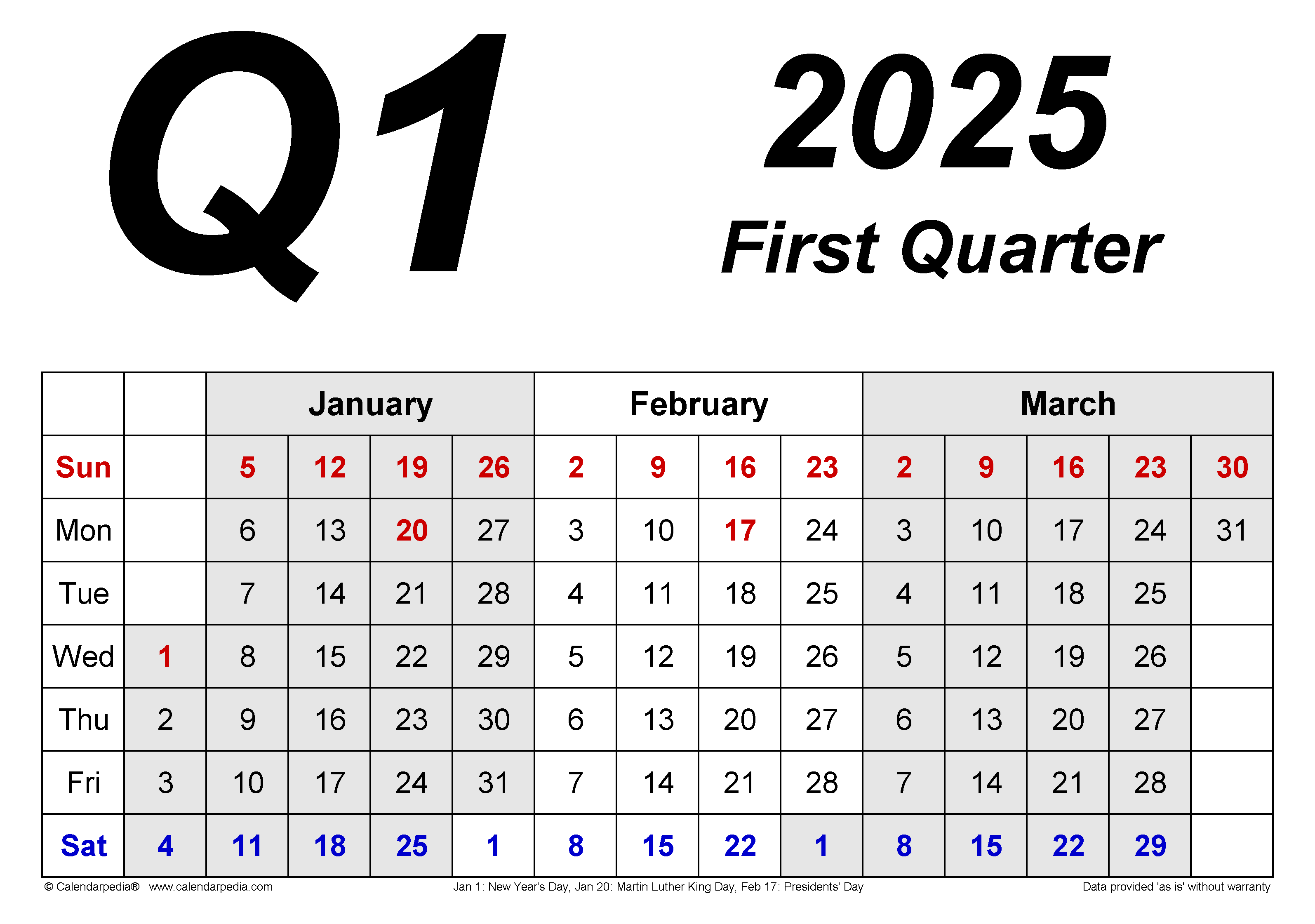

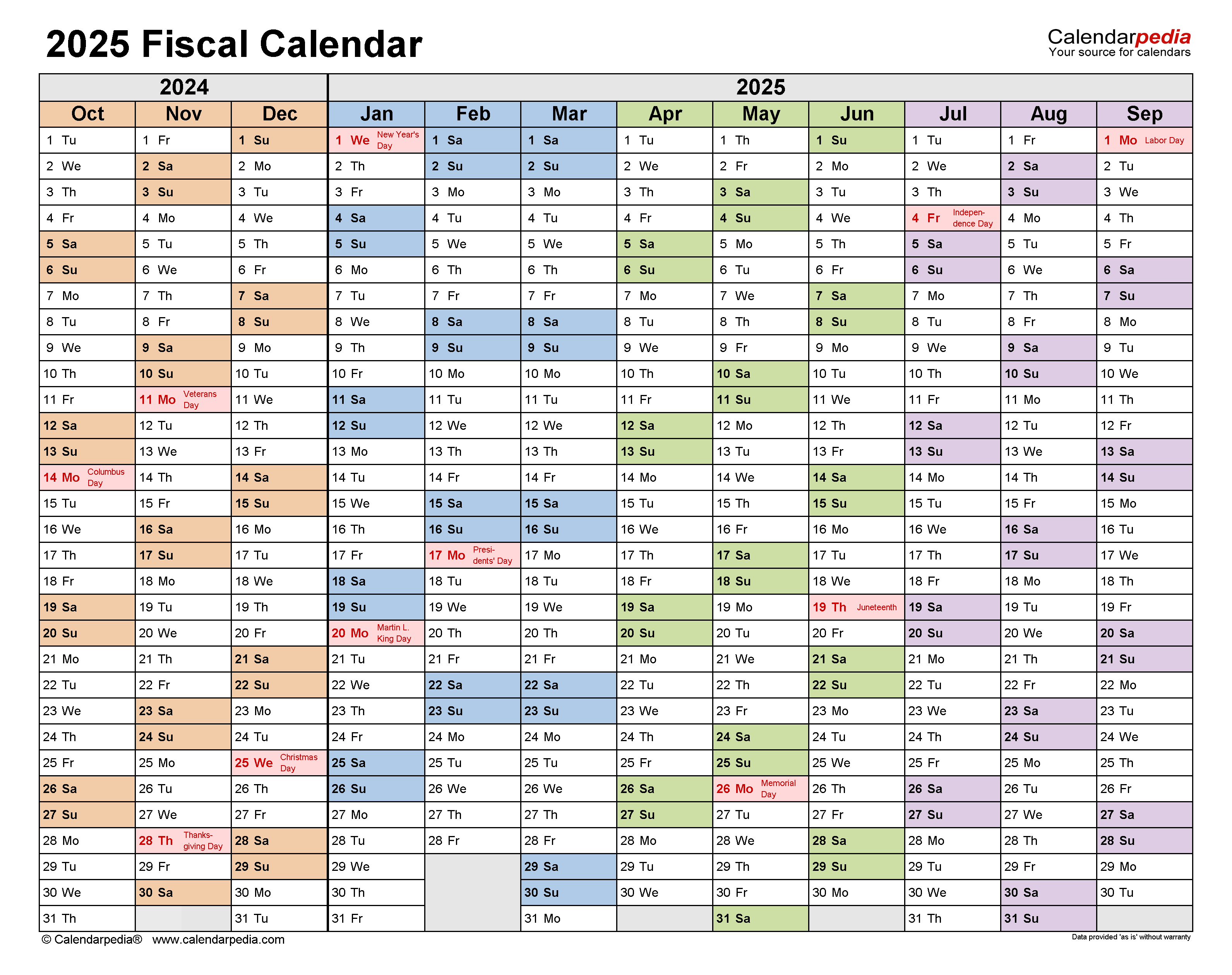

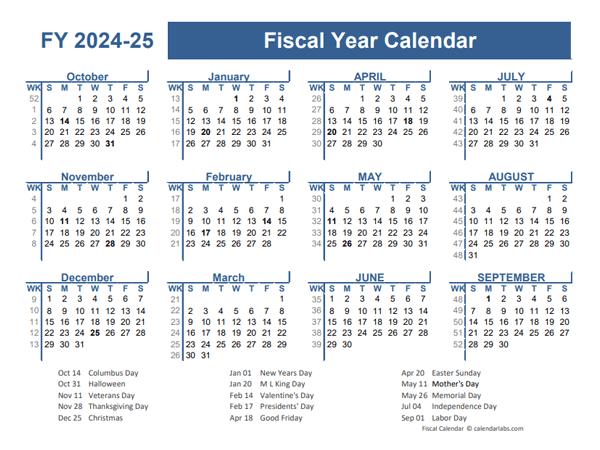

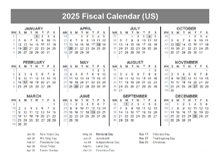

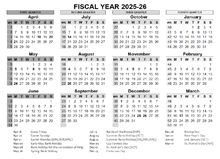

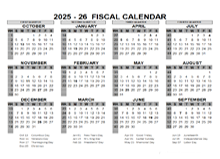

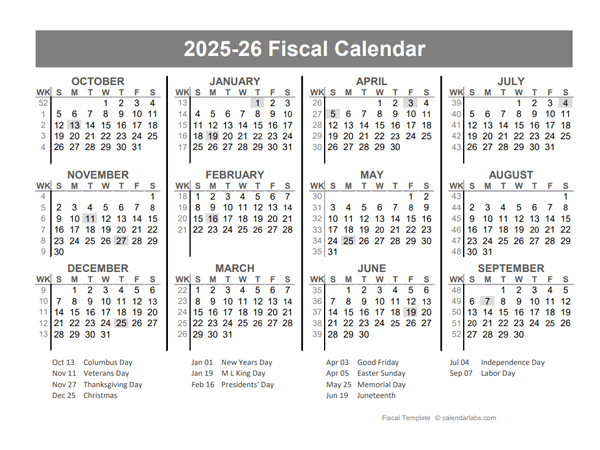

The 2025 quarters calendar is built upon the standard fiscal year, which typically runs from January 1st to December 31st. It divides this period into four quarters, each encompassing three consecutive months. The quarters are designated as follows:

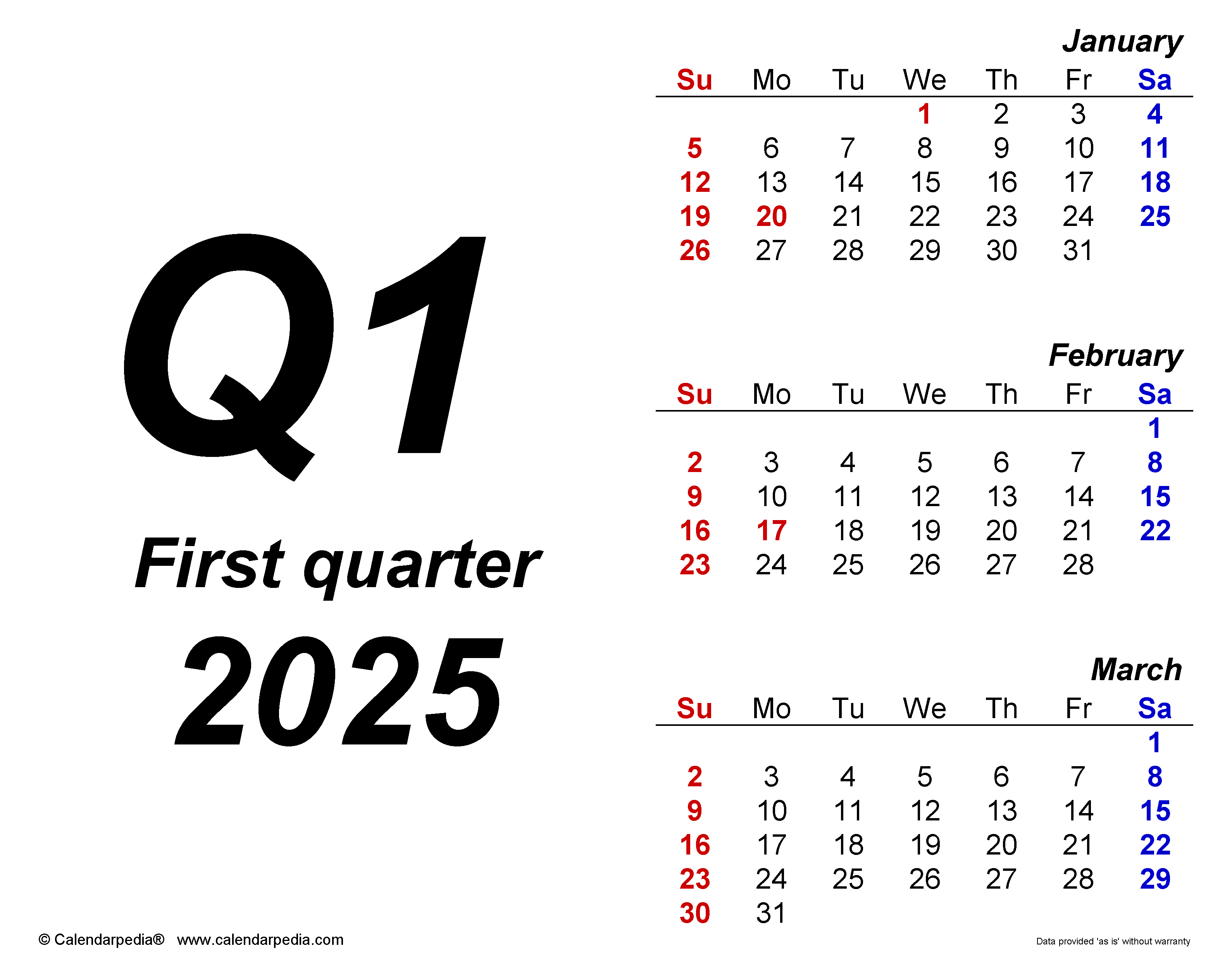

- Quarter 1 (Q1): January – March

- Quarter 2 (Q2): April – June

- Quarter 3 (Q3): July – September

- Quarter 4 (Q4): October – December

Applications of the 2025 Quarters Calendar:

The 2025 quarters calendar holds significance across various sectors, offering a standardized framework for financial management and analysis.

1. Business Planning and Operations:

- Budgeting and Forecasting: Businesses utilize the quarters calendar to create and manage their budgets, forecasting revenues and expenses for each period. This facilitates effective financial planning and resource allocation.

- Performance Tracking: The calendar allows businesses to track their performance on a quarterly basis, comparing actual results against planned targets. This enables timely identification of areas requiring improvement and adjustments to operational strategies.

- Reporting and Analysis: Businesses generate quarterly financial reports, providing stakeholders with a clear picture of their performance and financial health. This facilitates informed decision-making and investor confidence.

2. Investment and Financial Analysis:

- Earnings Reports: Publicly traded companies release their earnings reports on a quarterly basis, providing investors with insights into their financial performance. This data is crucial for investment decisions, market analysis, and understanding company growth trajectories.

- Market Trends and Volatility: The quarters calendar helps investors track market trends and volatility. Quarterly data points provide insights into economic performance, industry trends, and potential risks, guiding investment strategies.

- Performance Measurement and Benchmarking: Investors use the quarters calendar to measure the performance of their portfolios and benchmark them against industry averages. This allows for informed portfolio management and adjustments based on market conditions.

3. Personal Finance and Budgeting:

- Goal Setting and Tracking: Individuals can use the quarters calendar to set financial goals and track their progress towards achieving them. This fosters financial discipline and promotes a proactive approach to personal finances.

- Savings and Spending Management: The calendar helps individuals manage their savings and spending habits, allocating funds effectively for various financial needs throughout the year.

- Tax Planning: Understanding the quarterly structure can assist individuals in planning their tax payments, ensuring timely compliance and maximizing tax benefits.

Benefits of Using the 2025 Quarters Calendar:

- Improved Financial Planning and Management: The calendar provides a structured framework for planning and managing financial resources, facilitating better budgeting, forecasting, and performance tracking.

- Enhanced Decision-Making: Quarterly data points offer valuable insights into financial performance, market trends, and company growth, supporting informed decision-making in various contexts.

- Increased Transparency and Accountability: The calendar promotes transparency by standardizing reporting and analysis, fostering accountability among businesses and investors.

- Streamlined Operations: The quarterly structure simplifies financial processes, streamlining operations and improving efficiency across different sectors.

FAQs Regarding the 2025 Quarters Calendar:

1. What is the difference between a calendar year and a fiscal year?

A calendar year runs from January 1st to December 31st, while a fiscal year can begin on any date, typically aligning with a business’s operational cycle. For example, a company’s fiscal year might start in June and end in May of the following year.

2. Why is the 2025 quarters calendar important for investors?

The calendar provides a structured framework for analyzing company performance, tracking market trends, and making informed investment decisions based on quarterly earnings reports and financial data.

3. How can I use the 2025 quarters calendar for personal finance?

The calendar helps set financial goals, track progress, manage savings and spending, and plan for tax obligations, fostering financial discipline and proactive financial management.

4. Are there any specific dates to remember within the 2025 quarters calendar?

Important dates within each quarter include earnings report release dates, tax filing deadlines, and other key financial events that may affect investment decisions or personal financial planning.

5. How can I access the 2025 quarters calendar?

The calendar is readily available online through various financial websites, calendars, and business resources. It is also often included in financial reports and investor guides.

Tips for Utilizing the 2025 Quarters Calendar:

- Align your financial goals with the quarters calendar: Break down long-term goals into quarterly targets, making them more manageable and trackable.

- Regularly review your financial performance: Analyze your progress against your quarterly goals, identify areas for improvement, and adjust your strategies accordingly.

- Stay informed about key dates and events: Be aware of important dates like earnings report releases, tax deadlines, and other financial events that may impact your decisions.

- Utilize financial tools and resources: Leverage online financial tools, calendars, and resources to track your progress, manage your finances, and make informed decisions.

Conclusion:

The 2025 quarters calendar is a valuable tool for navigating the fiscal landscape, providing a structured framework for businesses, investors, and individuals alike. Its standardized structure enables efficient planning, tracking, and analysis of financial performance, supporting informed decision-making and fostering financial growth. By understanding its applications and benefits, individuals and organizations can leverage the calendar to achieve their financial objectives and navigate the complexities of the fiscal year effectively.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Fiscal Landscape: A Comprehensive Guide to the 2025 Quarters Calendar. We appreciate your attention to our article. See you in our next article!