Navigating the Financial Landscape: Understanding the Central Bank Calendar

Related Articles: Navigating the Financial Landscape: Understanding the Central Bank Calendar

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Financial Landscape: Understanding the Central Bank Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Financial Landscape: Understanding the Central Bank Calendar

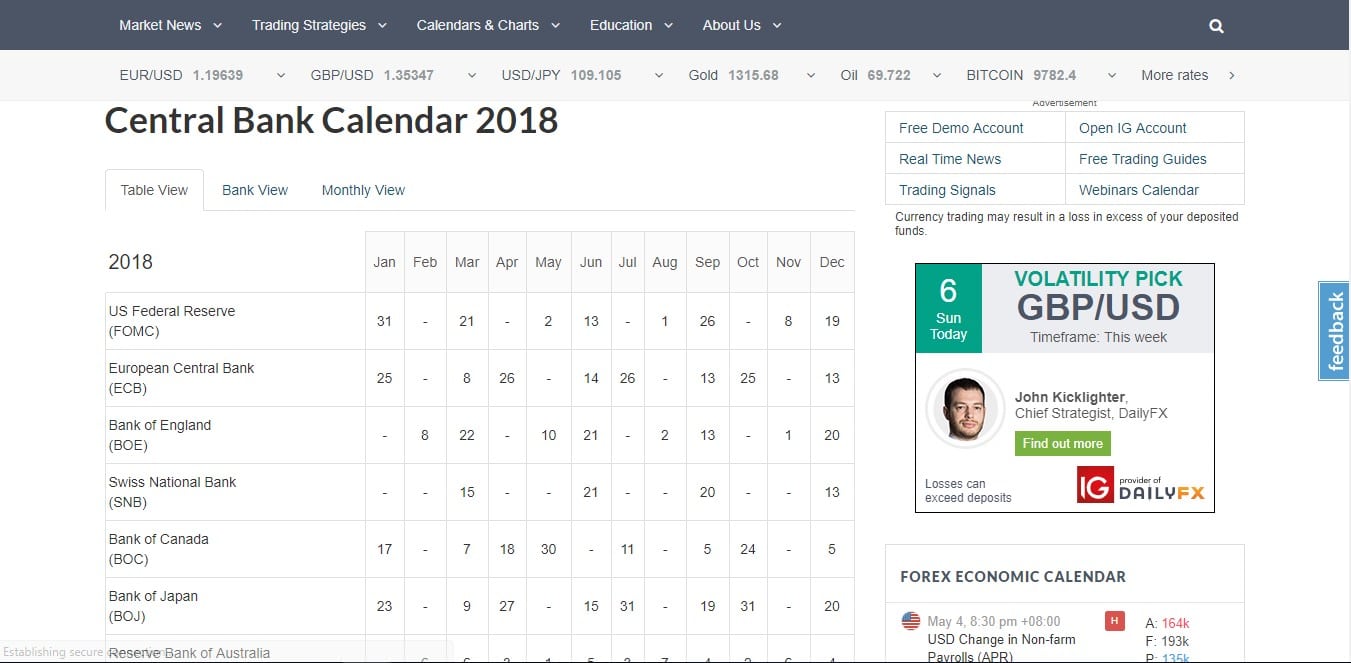

The global financial system operates on a complex interplay of forces, with central banks playing a pivotal role in shaping economic conditions. Understanding the decisions and actions of these institutions is crucial for investors, businesses, and policymakers alike. This is where the central bank calendar emerges as an indispensable tool, providing a comprehensive overview of upcoming events and announcements that can significantly impact financial markets.

Decoding the Central Bank Calendar: A Roadmap for Market Movements

The central bank calendar serves as a meticulously curated schedule of key economic events and policy announcements released by central banks around the world. These events include:

- Interest Rate Decisions: Central banks often adjust interest rates to influence economic activity. A rate hike signals a tightening of monetary policy, aiming to curb inflation and potentially slow economic growth. Conversely, a rate cut indicates a loosening of policy, aiming to stimulate economic activity.

- Monetary Policy Statements: These statements accompany interest rate decisions, providing further insight into the central bank’s rationale, economic outlook, and future policy intentions.

- Inflation Reports: Central banks release regular inflation reports, providing data on the rate of price increases in the economy. These reports are closely watched as they offer valuable insights into the effectiveness of current monetary policies and potential future adjustments.

- Economic Projections: Many central banks publish economic forecasts, providing insights into their expectations for future economic growth, inflation, and unemployment. These projections can influence market sentiment and investment decisions.

- Press Conferences: Following key announcements, central bank officials often hold press conferences to answer questions from journalists and elaborate on their decisions and outlook. These conferences can provide valuable insights into the central bank’s thinking and potential future actions.

Navigating the Calendar: Key Considerations for Market Participants

The central bank calendar is a powerful tool for understanding and navigating the financial landscape. By carefully monitoring these events, investors, businesses, and policymakers can:

- Anticipate Market Volatility: Key central bank announcements often trigger significant market movements. By staying informed about upcoming events, market participants can better prepare for potential volatility and adjust their strategies accordingly.

- Gain Insights into Economic Trends: Central bank decisions and pronouncements offer valuable insights into the economic health of a region or country. By analyzing these events, investors and businesses can gain a deeper understanding of current economic conditions and potential future trends.

- Inform Investment Decisions: Understanding the central bank’s policy stance and economic outlook can help investors make more informed investment decisions. By analyzing the implications of upcoming events, investors can adjust their portfolios to capitalize on potential opportunities or mitigate risks.

- Monitor Policy Effectiveness: The central bank calendar provides a platform for monitoring the effectiveness of current monetary policies. By analyzing the impact of past decisions and upcoming announcements, policymakers can gain valuable insights into the effectiveness of their strategies and potentially adjust their approach as needed.

FAQs Regarding the Central Bank Calendar

1. What are the most important central banks to follow?

The most prominent central banks include:

- Federal Reserve (Fed) (United States): The Fed’s decisions have a significant impact on global financial markets due to the size and influence of the US economy.

- European Central Bank (ECB): The ECB manages monetary policy for the Eurozone, a large economic bloc with significant global influence.

- Bank of England (BoE): The BoE sets monetary policy for the UK, a major financial center with a global impact.

- Bank of Japan (BOJ): The BOJ’s decisions influence the Japanese economy and have implications for global markets.

- Swiss National Bank (SNB): The SNB’s actions impact the Swiss franc, a safe-haven currency often sought during times of global uncertainty.

2. How can I access a central bank calendar?

Numerous websites and financial news providers offer central bank calendars. Some popular options include:

- Investing.com: Provides a comprehensive calendar with customizable filters for different regions and central banks.

- Reuters: Offers a detailed calendar with information on upcoming events and past announcements.

- Bloomberg: Provides a comprehensive calendar with access to real-time data and analysis.

- Central bank websites: Most central banks publish their own calendars on their websites, offering official information and announcements.

3. What are the best ways to analyze central bank announcements?

Analyzing central bank announcements requires a multi-faceted approach:

- Focus on the key takeaways: Identify the core message of the announcement, including interest rate decisions, policy changes, and economic outlook.

- Consider the context: Analyze the announcement in light of current economic conditions, previous policy decisions, and market expectations.

- Pay attention to the wording: Central banks often use specific language to signal their intentions and potential future actions. Analyze the tone and wording for subtle clues about their policy stance.

- Seek expert analysis: Consult with financial analysts and economists for their insights and interpretations of central bank announcements.

Tips for Utilizing the Central Bank Calendar Effectively

- Customize your calendar: Tailor the calendar to your specific needs by filtering for events relevant to your region, asset class, or investment strategy.

- Set reminders: Schedule alerts for upcoming events to ensure you don’t miss crucial announcements.

- Stay informed about central bank communication: Familiarize yourself with the communication styles and key indicators used by different central banks.

- Combine the calendar with other economic data: Analyze central bank announcements in conjunction with other economic indicators, such as inflation data, GDP growth, and unemployment figures.

- Consider the impact on different asset classes: Understand how central bank decisions can influence various asset classes, including stocks, bonds, currencies, and commodities.

Conclusion

The central bank calendar is an indispensable tool for anyone seeking to navigate the complex and dynamic world of finance. By understanding the importance of these events and leveraging the information they provide, investors, businesses, and policymakers can make more informed decisions, anticipate market movements, and effectively manage their financial strategies. As the global economy continues to evolve, the central bank calendar will remain a vital resource for navigating the ever-changing financial landscape.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Financial Landscape: Understanding the Central Bank Calendar. We thank you for taking the time to read this article. See you in our next article!