Navigating the Financial Landscape: Understanding the 2025 Biweekly Pay Period Calendar

Related Articles: Navigating the Financial Landscape: Understanding the 2025 Biweekly Pay Period Calendar

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Financial Landscape: Understanding the 2025 Biweekly Pay Period Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Financial Landscape: Understanding the 2025 Biweekly Pay Period Calendar

- 2 Introduction

- 3 Navigating the Financial Landscape: Understanding the 2025 Biweekly Pay Period Calendar

- 3.1 Understanding Biweekly Pay Periods

- 3.2 Navigating the 2025 Biweekly Pay Period Calendar

- 3.3 Utilizing the 2025 Biweekly Pay Period Calendar for Effective Financial Management

- 3.4 FAQs: Biweekly Pay Period Calendar 2025

- 3.5 Tips for Effective Financial Management with the Biweekly Pay Period Calendar

- 3.6 Conclusion: Embracing the 2025 Biweekly Pay Period Calendar for Financial Success

- 4 Closure

Navigating the Financial Landscape: Understanding the 2025 Biweekly Pay Period Calendar

The concept of a pay period calendar may seem like a simple administrative detail, but it plays a crucial role in managing personal finances. For individuals and businesses alike, understanding the timing of paychecks facilitates budgeting, planning for financial goals, and ensuring timely bill payments. This article delves into the 2025 biweekly pay period calendar, offering a comprehensive guide to its structure, benefits, and implications for financial management.

Understanding Biweekly Pay Periods

A biweekly pay period signifies that employees receive their salary every two weeks. This payment frequency is a common practice in many industries, offering several advantages for both employers and employees.

Benefits of Biweekly Pay Periods

- Consistent Income Stream: Employees receive a predictable income flow, allowing them to better manage their expenses and plan for future financial needs.

- Enhanced Financial Control: Biweekly payments provide a regular opportunity for individuals to track their income and spending, fostering financial discipline and awareness.

- Improved Cash Flow Management: Employers benefit from a stable payroll schedule, enabling efficient cash flow management and minimizing potential financial strain.

- Simplified Budgeting: Predictable income allows for easier budgeting, as individuals can anticipate their earnings and allocate funds accordingly.

Navigating the 2025 Biweekly Pay Period Calendar

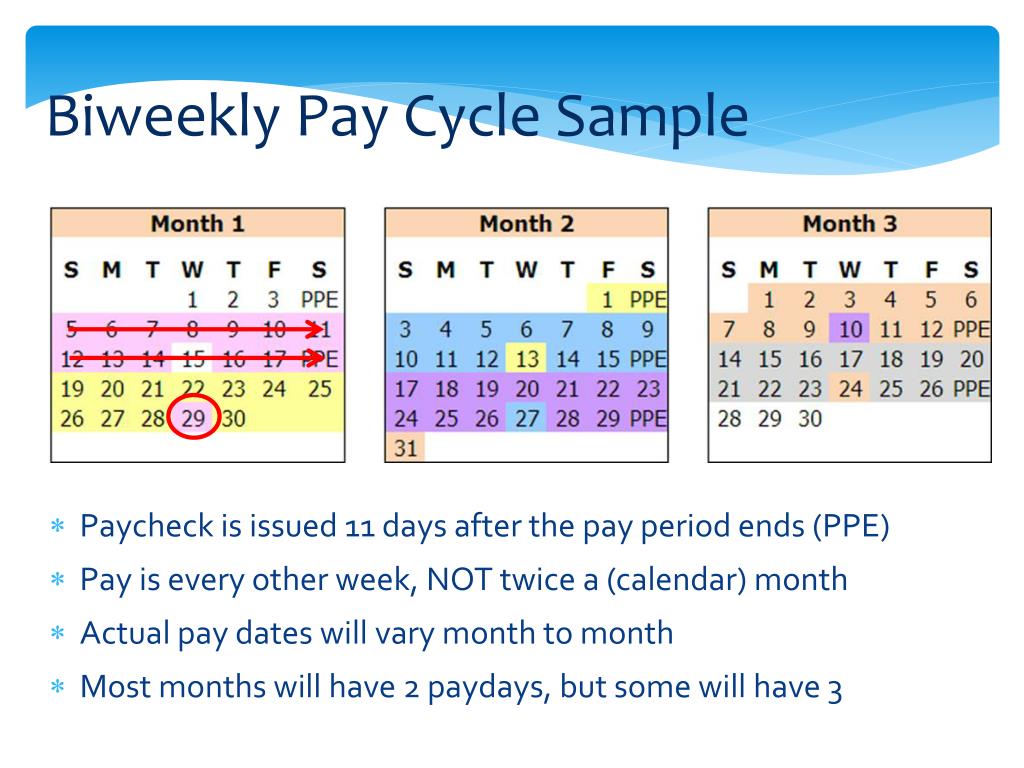

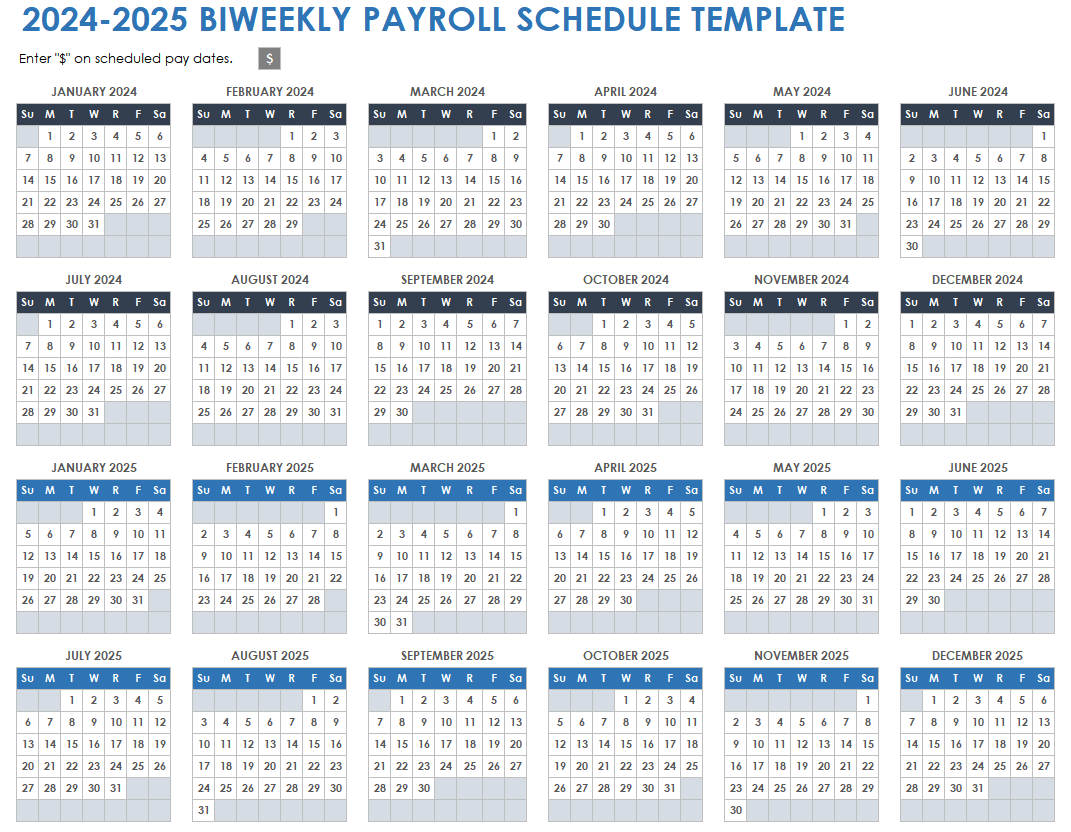

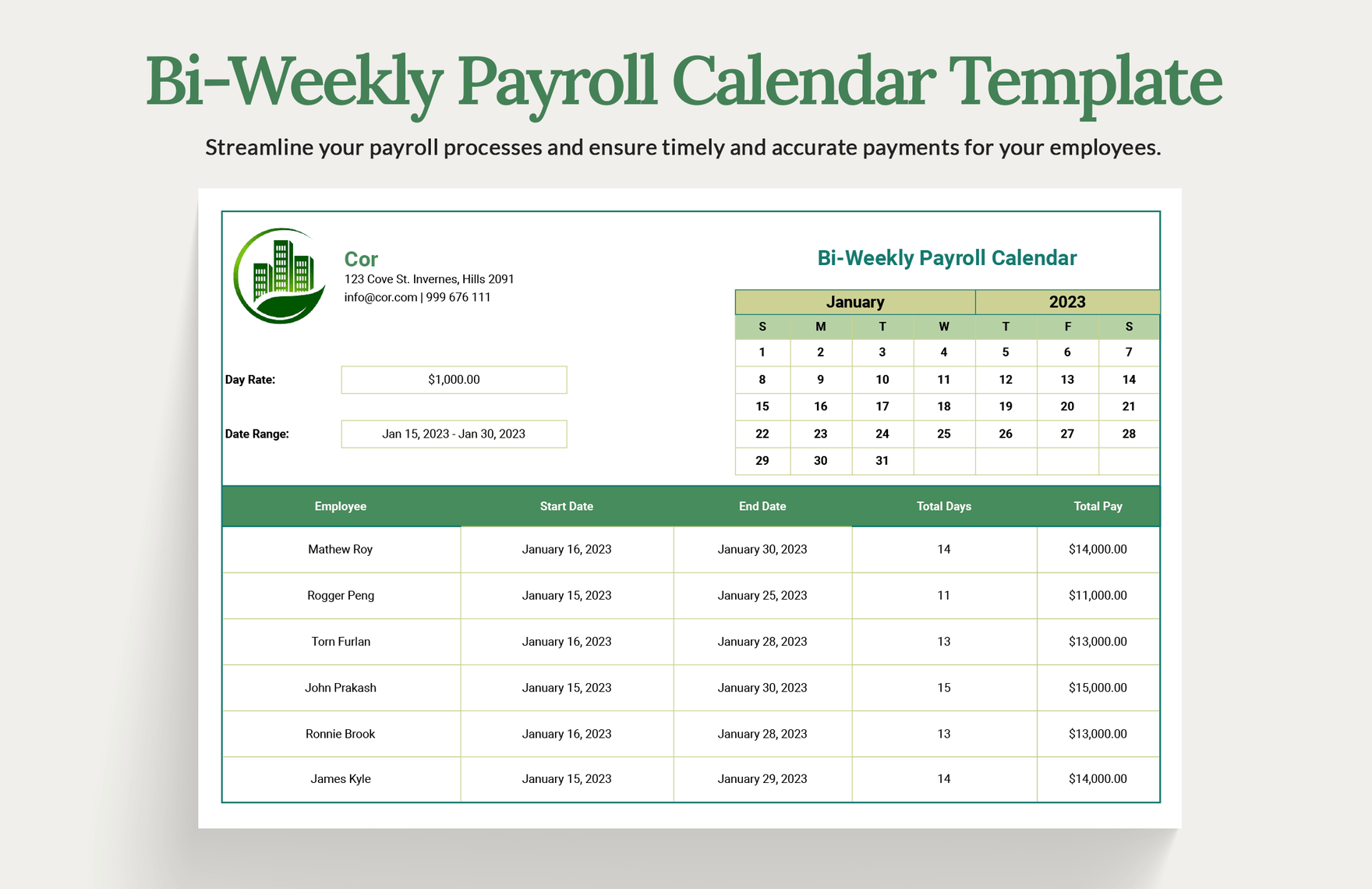

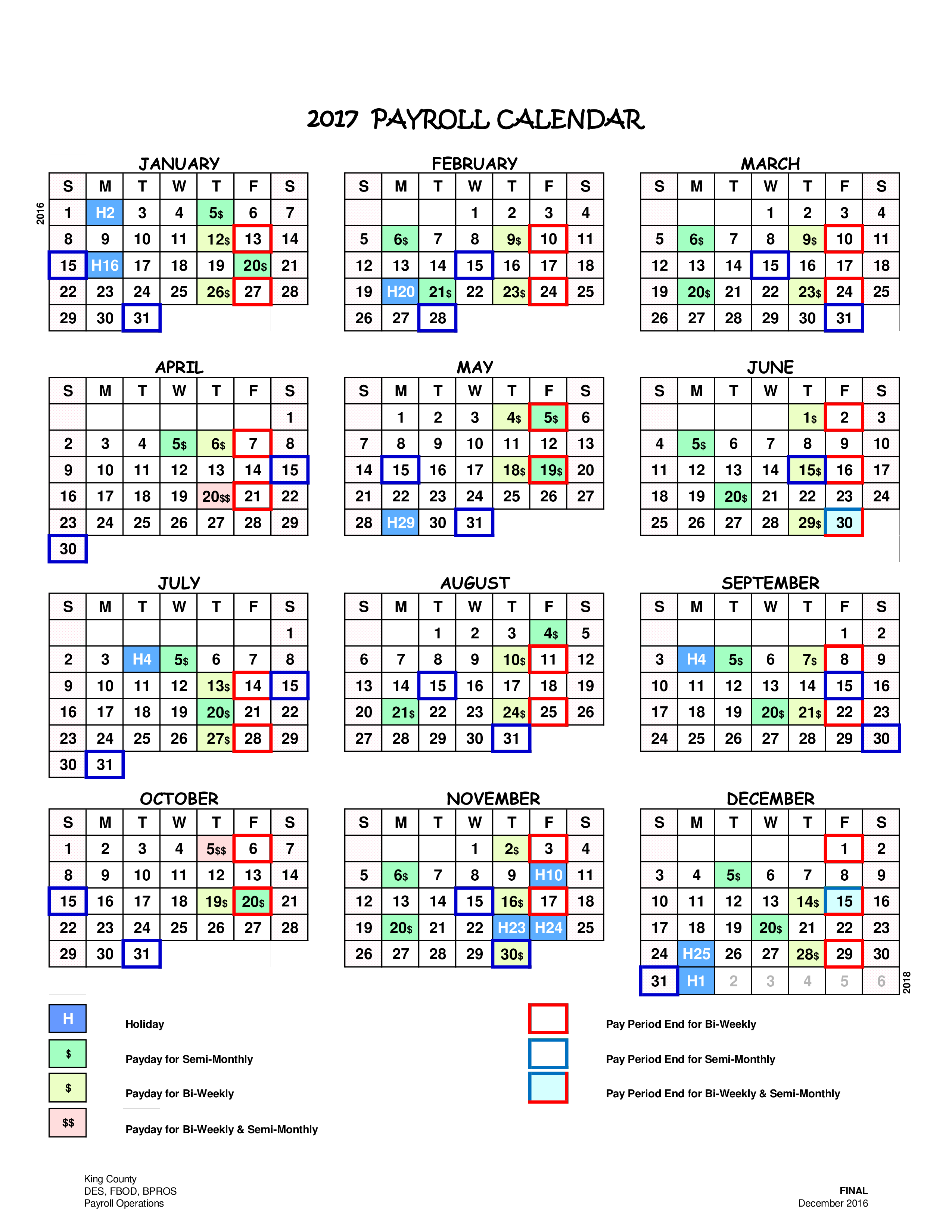

The 2025 biweekly pay period calendar follows a specific pattern determined by the number of days in each month and the designated payday. To illustrate this, let’s examine a hypothetical example:

Scenario:

- Payday: Every other Friday

- Start Date: January 3, 2025

The first paycheck of the year would fall on January 3rd, followed by the second paycheck on January 17th. This pattern continues throughout the year, with paydays occurring every other Friday. It’s crucial to note that the calendar may differ slightly depending on the specific payday chosen by the employer.

Utilizing the 2025 Biweekly Pay Period Calendar for Effective Financial Management

The 2025 biweekly pay period calendar can be a valuable tool for individuals seeking to enhance their financial well-being. Here’s how:

- Budgeting and Savings: By aligning spending with the biweekly income cycle, individuals can create a structured budget that allocates funds for essential expenses, savings, and financial goals.

- Debt Management: The consistent income flow facilitated by biweekly pay periods can aid in debt repayment strategies, allowing individuals to allocate a specific portion of their earnings towards reducing outstanding debt.

- Investment Planning: Regular income provides a consistent source of funds for investment opportunities, enabling individuals to grow their wealth over time.

- Emergency Fund Building: The biweekly pay period structure offers a chance to set aside a portion of each paycheck for an emergency fund, providing financial security in unforeseen circumstances.

FAQs: Biweekly Pay Period Calendar 2025

Q: What are the specific pay dates for the 2025 biweekly pay period calendar?

A: The specific pay dates for the 2025 biweekly pay period calendar vary depending on the designated payday chosen by the employer. It’s essential to consult with your employer or payroll department for accurate dates.

Q: How can I create a budget based on the biweekly pay period calendar?

A: To create a budget, start by tracking your income and expenses for a few months. Then, use the 2025 biweekly pay period calendar to determine the specific dates you’ll receive your paycheck. Allocate funds for essential expenses, savings, and debt repayment.

Q: How often do biweekly pay periods occur in a year?

A: A biweekly pay period calendar typically has 26 paychecks in a year, as there are 52 weeks in a year.

Q: What are some potential challenges associated with biweekly pay periods?

A: While biweekly pay periods offer benefits, potential challenges include:

- Fluctuating Monthly Income: Individuals may experience variations in monthly income depending on the number of paychecks in a particular month.

- Potential for Overspending: The regular income flow may lead to overspending if not carefully managed.

Q: How can I avoid overspending with a biweekly pay period?

A: To avoid overspending, create a detailed budget, track your expenses, and prioritize essential needs. Consider using budgeting tools or apps to manage your finances effectively.

Tips for Effective Financial Management with the Biweekly Pay Period Calendar

- Automate Savings: Set up automatic transfers from your checking account to your savings account on each payday.

- Track Expenses: Regularly monitor your spending habits to identify areas where you can cut back.

- Review Budget Regularly: Adjust your budget as needed to reflect changes in your income, expenses, or financial goals.

- Seek Financial Advice: Consult with a financial advisor for personalized guidance on managing your finances effectively.

Conclusion: Embracing the 2025 Biweekly Pay Period Calendar for Financial Success

The 2025 biweekly pay period calendar offers a structured framework for managing personal finances effectively. By understanding its structure and utilizing its benefits, individuals can gain greater control over their financial well-being. From budgeting and savings to debt management and investment planning, the biweekly pay period calendar empowers individuals to make informed financial decisions and achieve their financial goals. Remember, consistent financial discipline, combined with a well-structured approach, is key to navigating the financial landscape successfully.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Financial Landscape: Understanding the 2025 Biweekly Pay Period Calendar. We appreciate your attention to our article. See you in our next article!