Navigating the Ex-Dividend Calendar: A Guide for Informed Investment Decisions

Related Articles: Navigating the Ex-Dividend Calendar: A Guide for Informed Investment Decisions

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Ex-Dividend Calendar: A Guide for Informed Investment Decisions. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Ex-Dividend Calendar: A Guide for Informed Investment Decisions

The financial landscape is a complex tapestry woven with various threads, each influencing the overall market dynamics. One such thread, often overlooked by casual investors, is the ex-dividend calendar. Understanding this calendar, its intricacies, and its impact on investment strategies can significantly enhance the overall returns for both seasoned and novice investors.

The Ex-Dividend Date: A Crucial Threshold

The ex-dividend date marks a critical juncture in the life cycle of a stock. It is the date on which a stock begins trading without the right to receive the upcoming dividend payment. Essentially, if you purchase a stock on or after the ex-dividend date, you are not entitled to the upcoming dividend. This seemingly straightforward concept holds significant weight in the investment world, affecting both the stock price and the potential returns for investors.

Understanding the Mechanics: A Step-by-Step Breakdown

To fully grasp the ex-dividend calendar, it is crucial to understand the sequence of events leading up to the dividend payment:

-

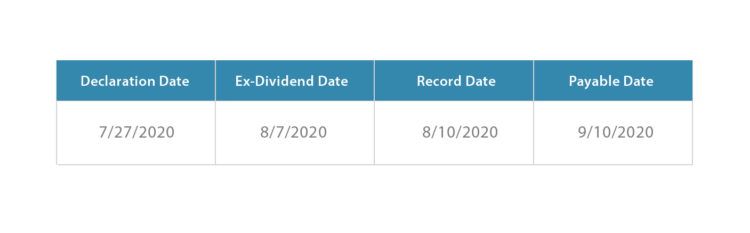

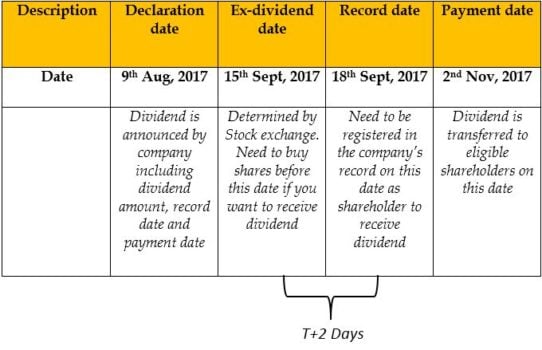

Declaration Date: The company’s board of directors announces the dividend payment, specifying the dividend amount, the record date, and the payment date.

-

Record Date: This date determines which shareholders are eligible to receive the dividend. Investors holding the stock on this date, as reflected in the company’s records, are entitled to the dividend.

-

Ex-Dividend Date: This date precedes the record date by a few days, typically two to three business days. From this date onwards, investors purchasing the stock are no longer entitled to the upcoming dividend.

-

Payment Date: The company disburses the dividend to eligible shareholders on this date.

The Impact of the Ex-Dividend Date on Stock Prices

The ex-dividend date significantly influences stock prices. As investors scramble to buy the stock before the ex-dividend date to secure their right to the dividend, demand increases, pushing the price up. Conversely, after the ex-dividend date, the stock price typically falls by an amount roughly equal to the dividend payment. This price drop is not necessarily a cause for concern, as it reflects the fact that the stock is now trading without the entitlement to the dividend.

Utilizing the Ex-Dividend Calendar for Strategic Advantage

While the ex-dividend date may seem like a mere technicality, it can be a valuable tool for investors seeking to maximize their returns. By strategically timing their trades around the ex-dividend date, investors can potentially:

-

Maximize Dividend Income: By buying stocks before the ex-dividend date, investors can ensure they receive the dividend payment.

-

Minimize Capital Losses: By selling stocks after the ex-dividend date, investors can avoid the price drop associated with the dividend payment.

-

Optimize Investment Strategies: The ex-dividend calendar can be integrated into various investment strategies, including dividend capture strategies, where investors aim to capitalize on the price drop after the ex-dividend date.

Navigating the Ex-Dividend Calendar: A Practical Guide

While the ex-dividend calendar can be a powerful tool, it is essential to approach it with caution and a comprehensive understanding. Here are some key points to consider:

-

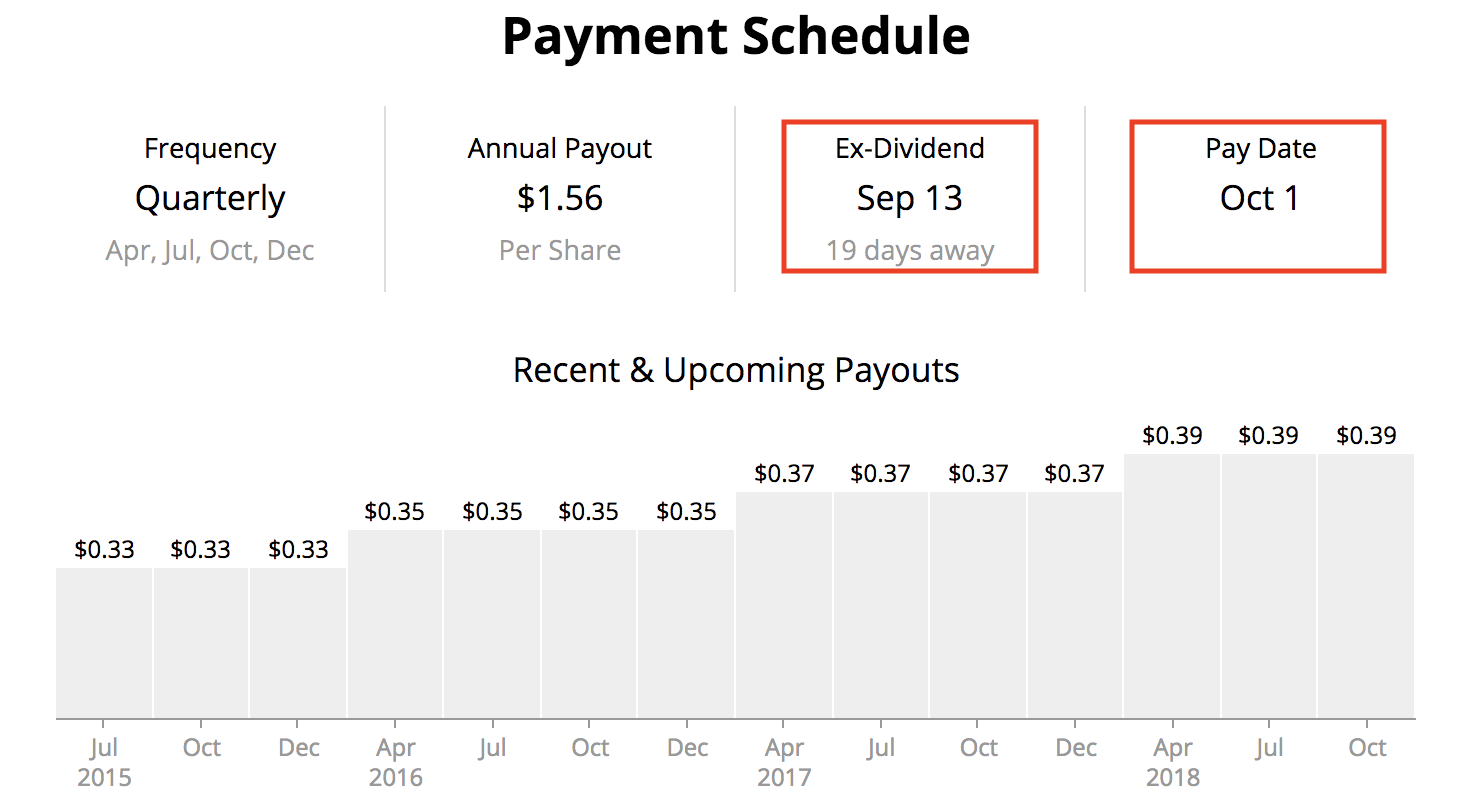

Dividend Yield: The dividend yield, calculated as the annual dividend divided by the stock price, can provide valuable insights into the potential return from dividends.

-

Dividend History: Examining the company’s dividend history can provide insights into its dividend policies and its commitment to dividend payments.

-

Tax Implications: Dividend payments are subject to taxation, and understanding the tax implications is crucial for optimizing investment strategies.

-

Market Volatility: Market volatility can significantly impact stock prices, potentially affecting the effectiveness of dividend capture strategies.

FAQs Regarding the Ex-Dividend Calendar

Q: What happens if I buy a stock on the ex-dividend date?

A: If you purchase a stock on the ex-dividend date, you will not be entitled to the upcoming dividend payment.

Q: Can I sell a stock before the ex-dividend date and still receive the dividend?

A: Yes, if you sell a stock before the ex-dividend date, you will receive the upcoming dividend payment.

Q: Is it always beneficial to buy a stock before the ex-dividend date?

A: Not necessarily. The potential benefits of buying before the ex-dividend date should be weighed against the potential price increase leading up to the ex-dividend date.

Q: How can I find the ex-dividend date for a particular stock?

A: You can find the ex-dividend date for a particular stock on financial websites like Yahoo Finance, Google Finance, or Bloomberg.

Tips for Utilizing the Ex-Dividend Calendar

-

Stay informed: Regularly monitor the ex-dividend calendar to stay updated on upcoming dividend payments.

-

Diversify your portfolio: Diversifying your investments across different sectors and industries can help mitigate risks associated with individual stocks.

-

Consult a financial advisor: Consider seeking advice from a qualified financial advisor to develop a personalized investment strategy that aligns with your financial goals.

Conclusion: Embracing the Ex-Dividend Calendar for Informed Investment Decisions

The ex-dividend calendar is an essential tool for investors seeking to maximize their returns and make informed investment decisions. By understanding its mechanics and incorporating it into their investment strategies, investors can capitalize on dividend payments, minimize capital losses, and optimize their overall returns. Remember, the ex-dividend date is not a magic bullet but rather a valuable tool that, when used wisely, can contribute to a more informed and profitable investment journey.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Ex-Dividend Calendar: A Guide for Informed Investment Decisions. We appreciate your attention to our article. See you in our next article!